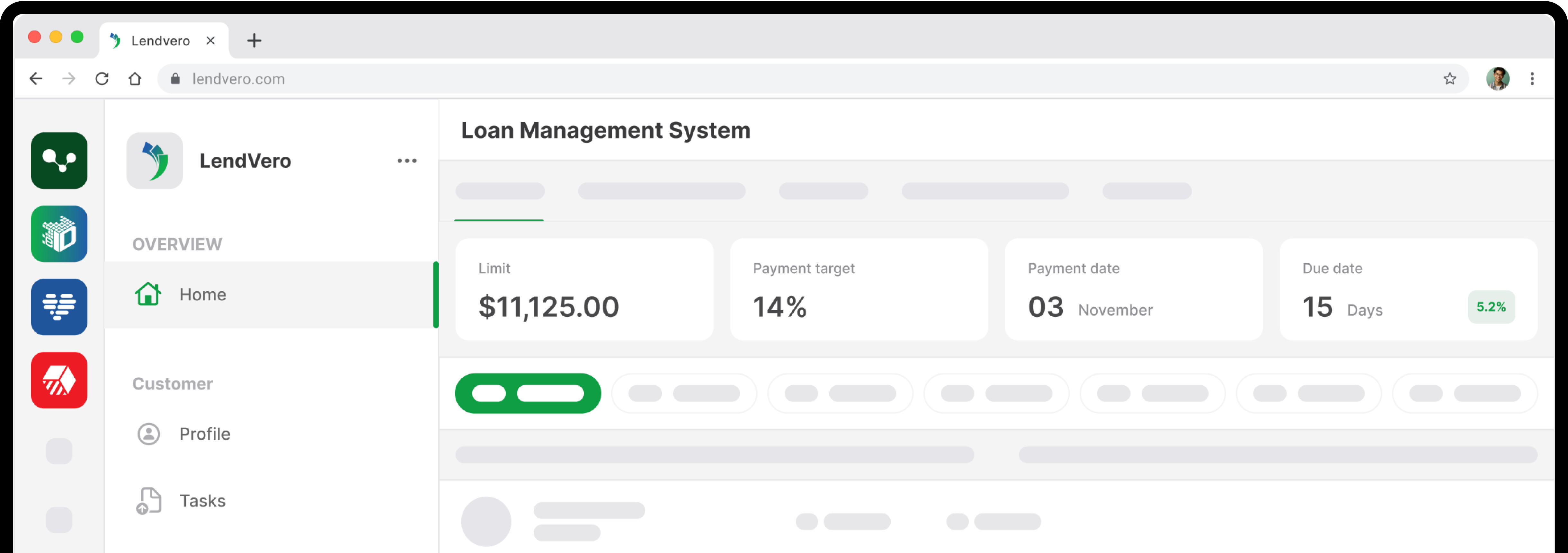

A Comprehensive Loan Management System

Streamline your loan management with LendVero. Managing loans from originating to debt collecting

Enhancing Competitive Advantage for Consumer Credit Organizations

Our solution manages loans end-to-end, enhancing risk assessment, disbursement, and debt collection. Experience seamless, transparent, and efficient services, improving customer satisfaction and addressing issues like slow processing times, errors, and security vulnerabilities. Transform your credit enterprise with improved efficiency and customer experience

LOS - Loan Origination System

Learn MoreDebt Collection

Learn MoreWhy LendVero

End-to-end loan management system

Streamline your loan management with LendVero. Managing loans from originating to debt collecting

Ask our expertsTechnology

01. Customer Acquisition Module

02. Loan Management Module

03. Sophisticated Collections

04. Enterprise Content Management

Improve customer experience with faster eKYC process, automated credit evaluation, and underwriting for a seamless process.

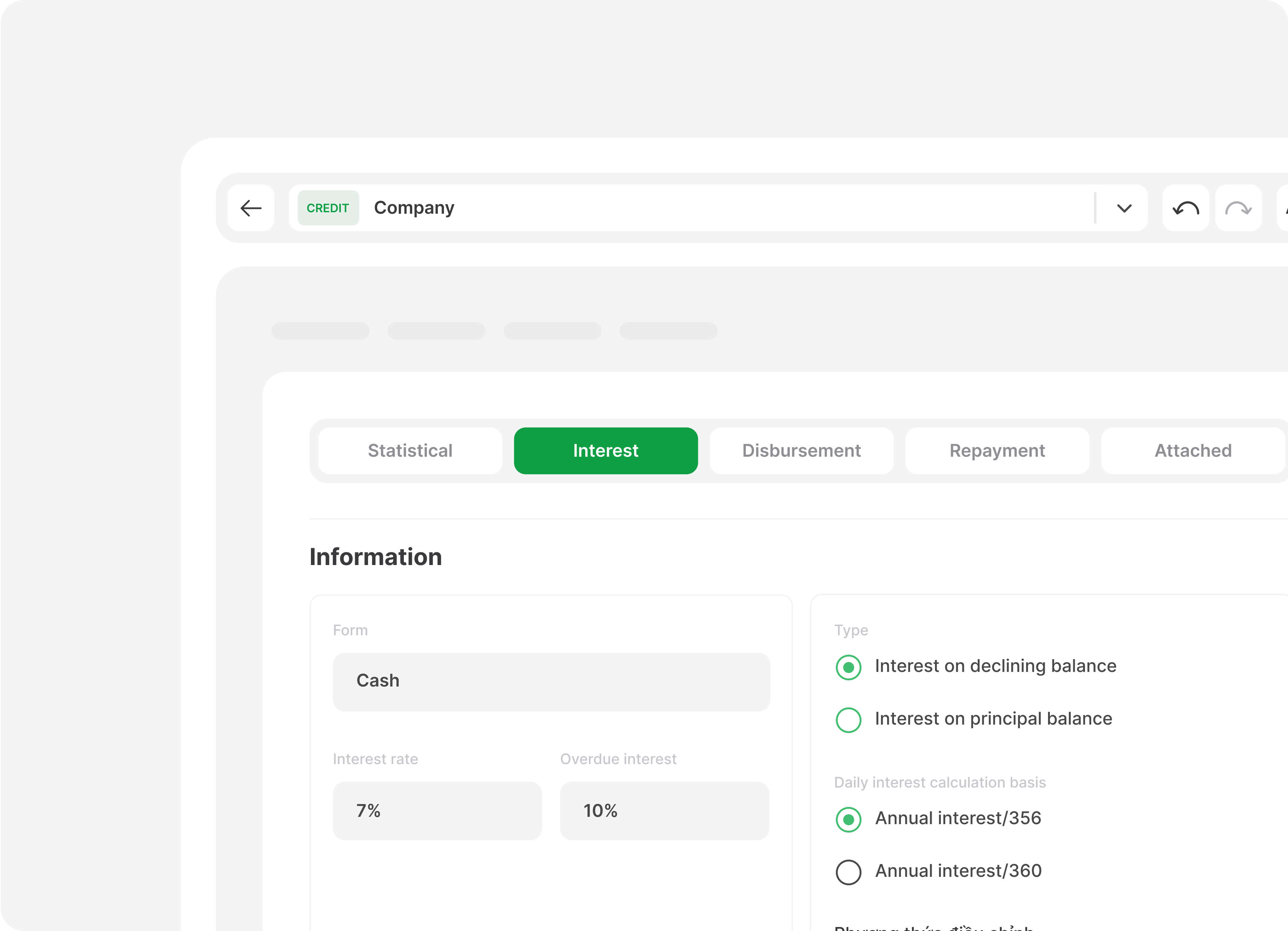

Empower loan servicing with a robust core engine. Utilize highly configurable rules for restructured repayment options, late payment penalties, and loan rescheduling.

An advanced platform offering extensive collections strategies, an automation-ready framework, and digital APIs for seamless interfaces. It supports end-to-end customer follow-up, is highly configurable and customer-centric, providing comprehensive customer exposure views to collection teams.

Intelligent content automation from upload and processing to search, retrieve and archive electronic documents. Seamless integration with multiple loan origination systems, helping lenders transition from paper-based to fully digitized operations.

.png)

.png)

News

The Benefits of Automation in Loan Approval: Why Businesses Must Embrace Digital Transformation

16 Sep - 2 min readInsights

Thank you for your interest

We’d love to hear from you!

Please contact us for new business or any other enquiries.