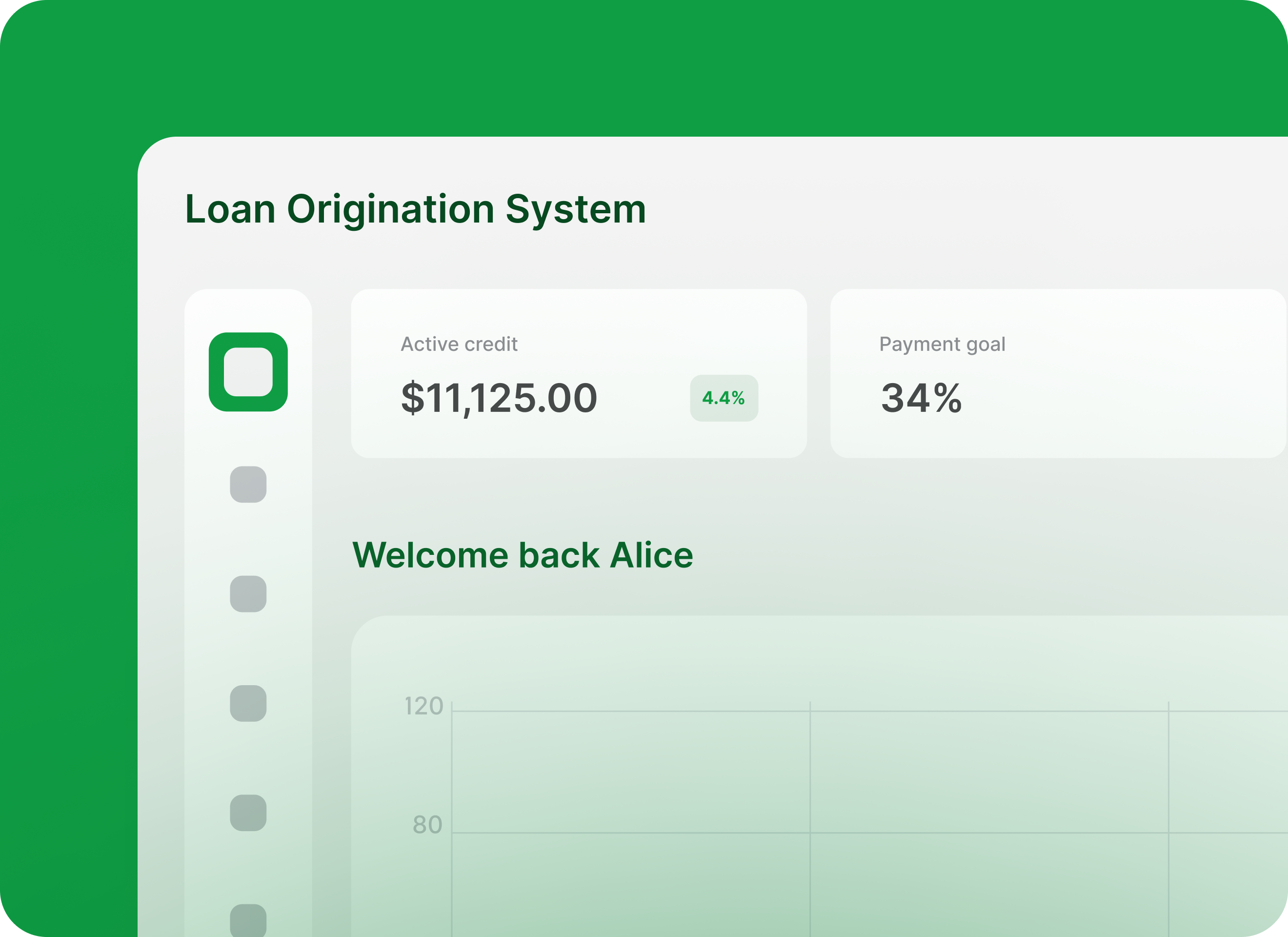

Loan Origination System (LOS)

A software system utilized in the financial industry to manage the processing and recording of loan requests from customers. This system is designed to streamline the process from customer loan application to loan approval or rejection.

Introduction solutions

- Digital onboarding

- Credit Decisioning

- Loan Simulation

- Document Management

- Reporting and Analytics

- Security and Data Privacy

- Integration Capabilities

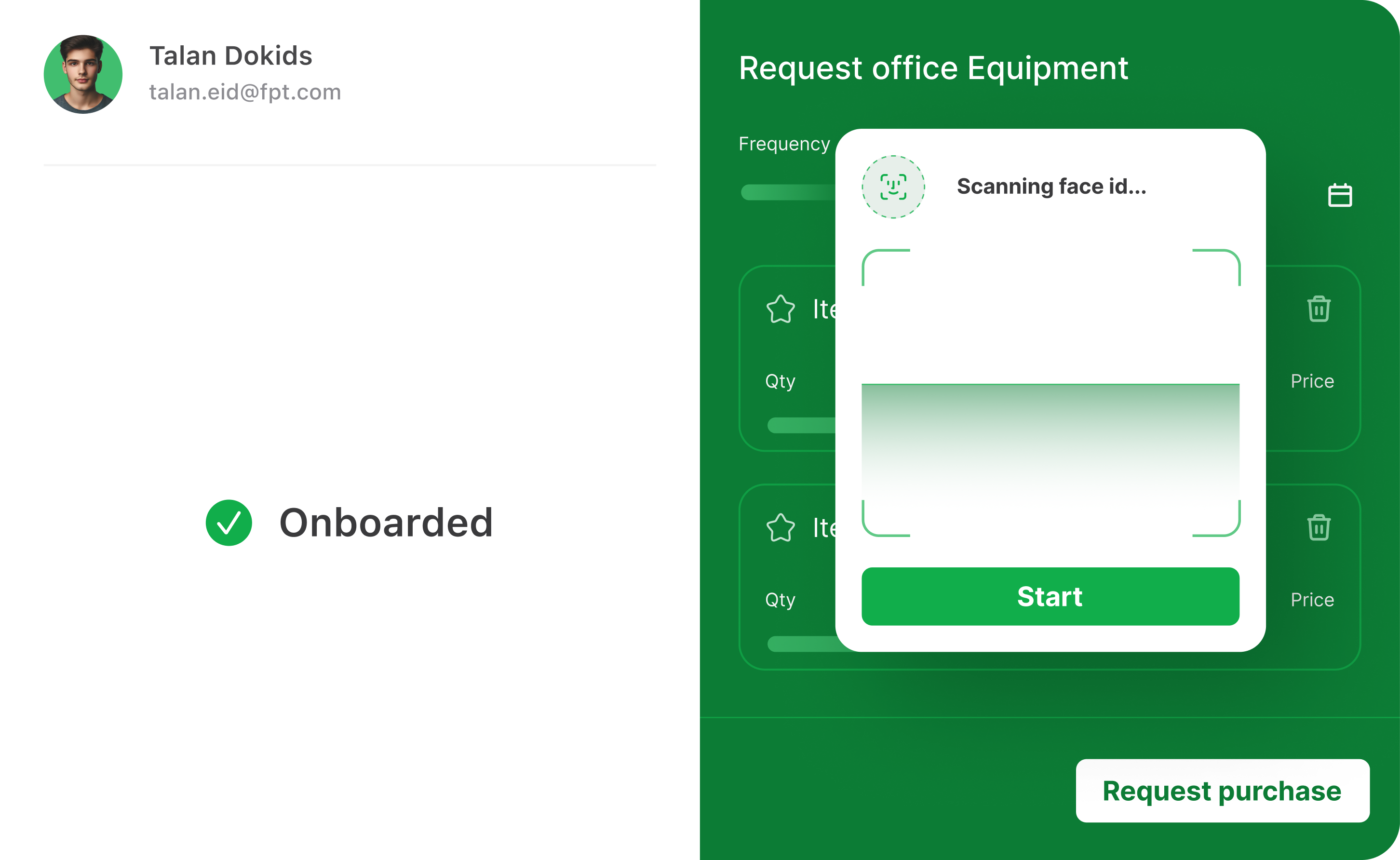

Digital onboarding

Using OCR to extract information on Citizen Identification Card and verify face biometrics

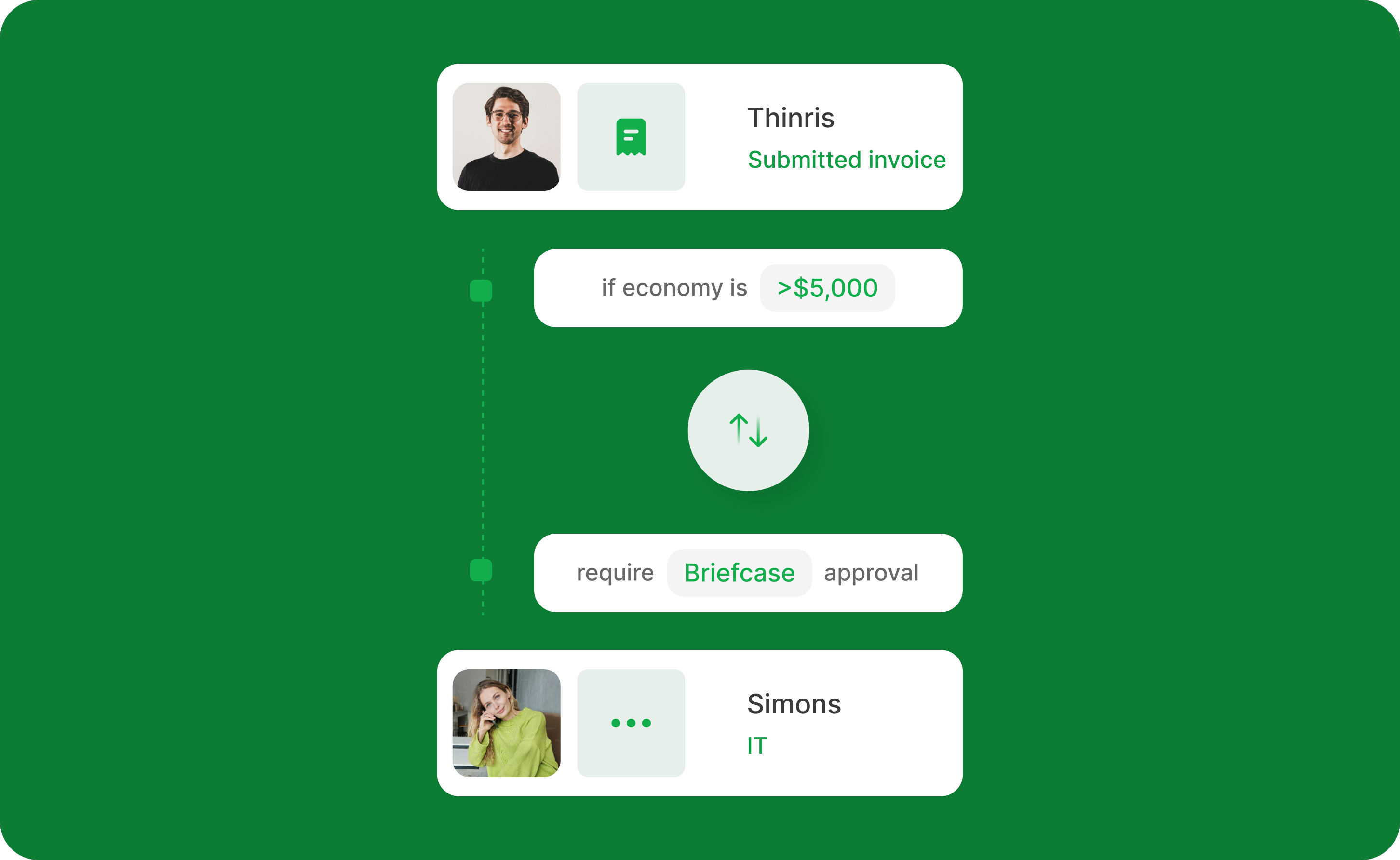

Credit Decisioning

Automated credit assessment and underwriting capabilities to evaluate the borrower's creditworthiness based on parameters like credit history, income, employment, and collateral,... which is flexible to set up.

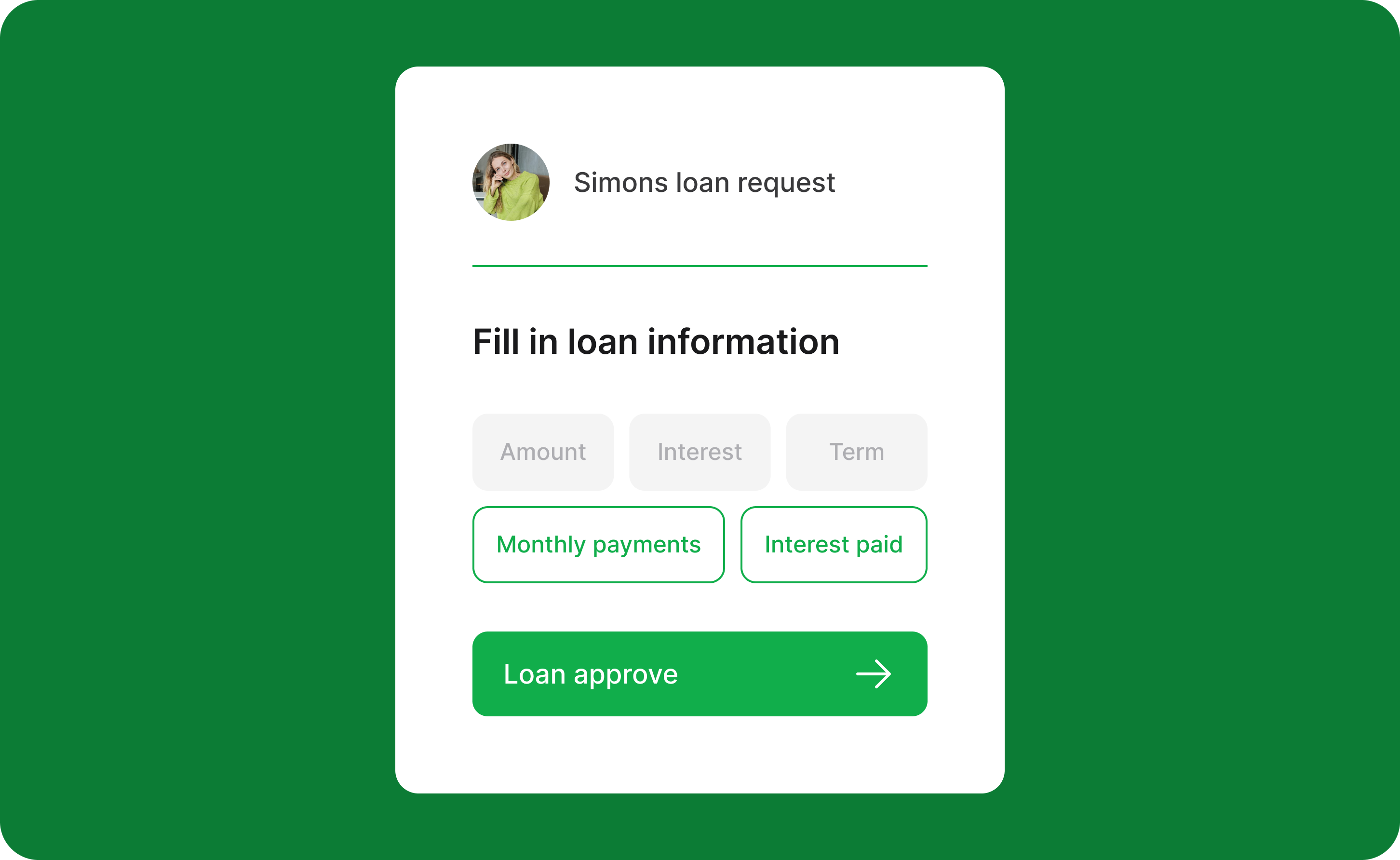

Loan Simulation

Allows borrowers to input various loan parameters, such as loan amount, interest rate, and repayment term, and receive an estimate of the monthly payments, total interest paid, and other key financial metrics.

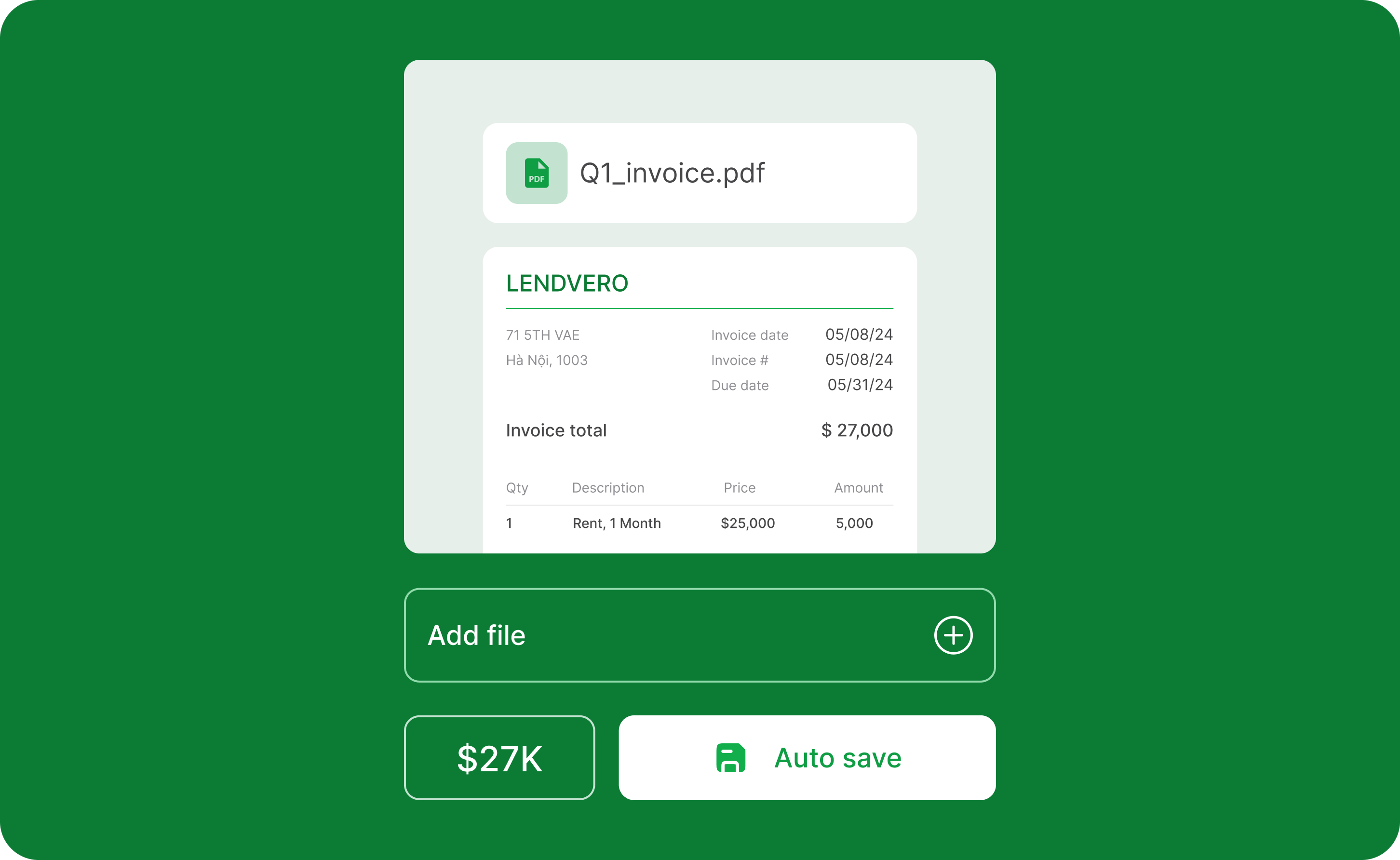

Document Management

Secure storage and management of all loan-related documents, including application forms, supporting financial statements, credit reports, and legal documents.

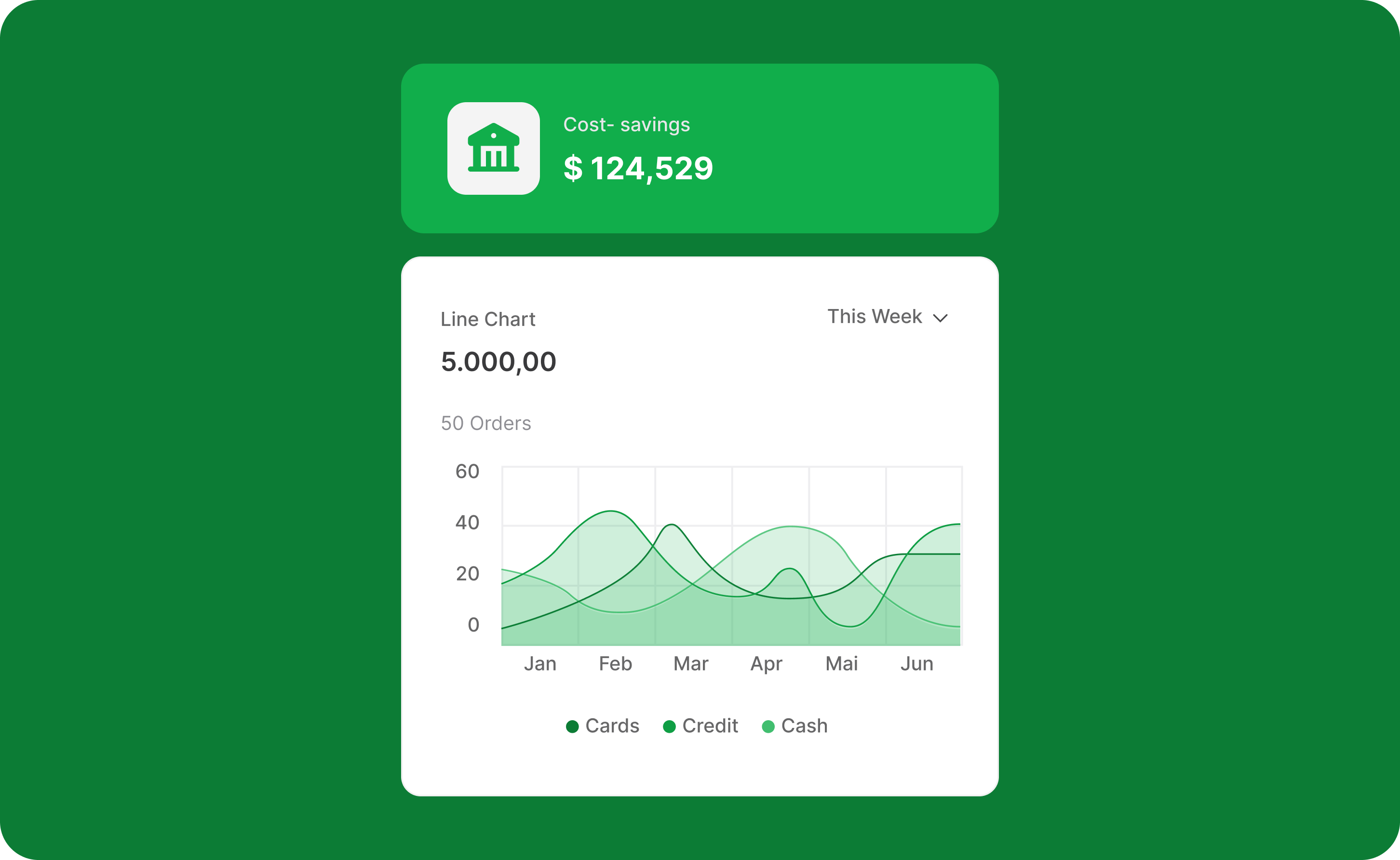

Reporting and Analytics

Comprehensive reporting and data analysis features to track key performance indicators, generate management reports, and gain insights into the loan portfolio.

Security and Data Privacy

Robust security measures to protect sensitive borrower information and comply with data privacy regulations.

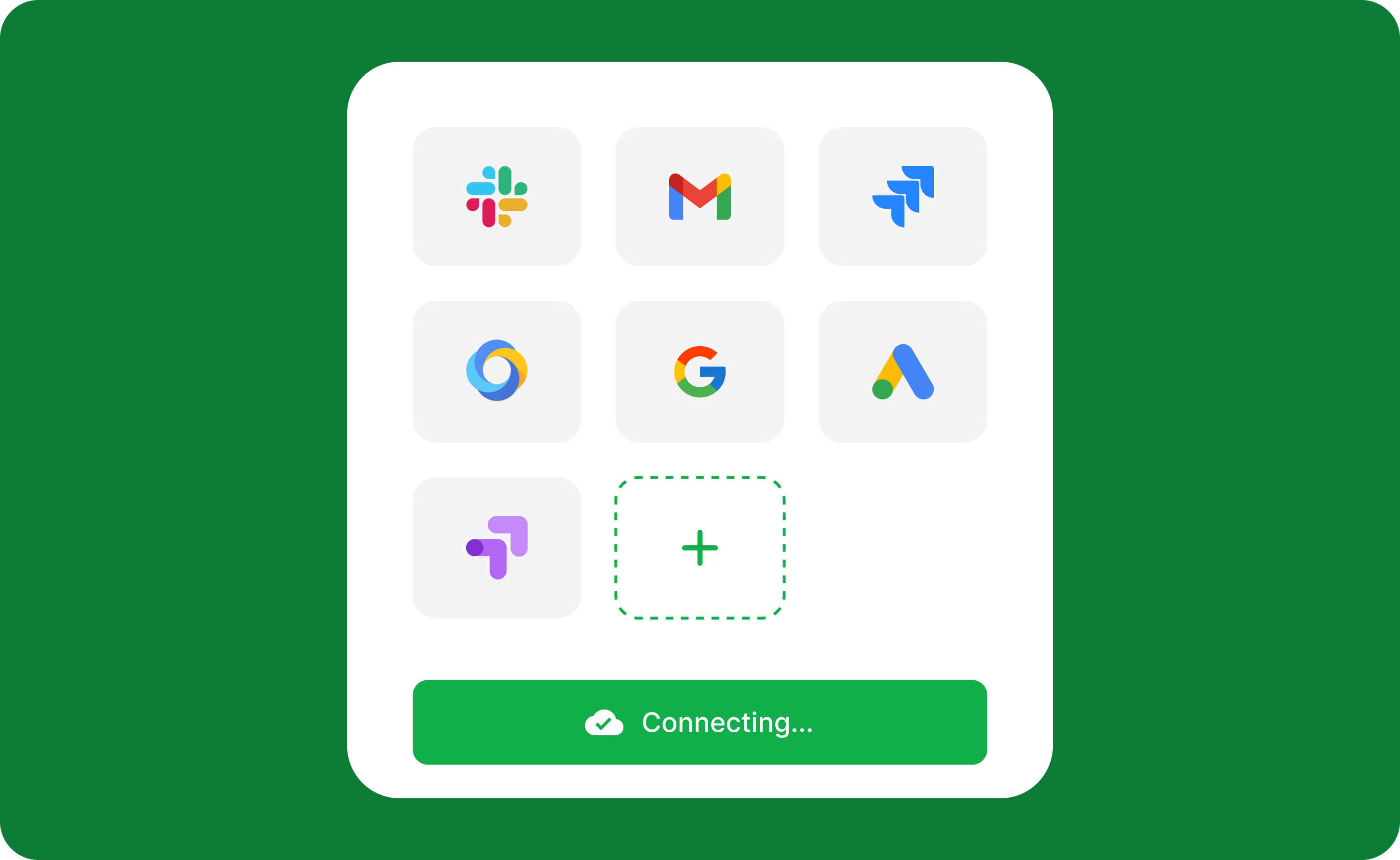

Integration Capabilities

The ability to seamlessly integrate with other systems, such as customer relationship management (CRM) tools, credit bureaus, property valuation platforms, and core banking systems.

News

The Benefits of Automation in Loan Approval: Why Businesses Must Embrace Digital Transformation

16 Sep - 2 min readInsights

Thank you for your interest

We’d love to hear from you!

Please contact us for new business or any other enquiries.