Loan Origination vs Loan Management - Differences You Need To Know

In the financial sector, the loan process doesn't end with approval; it extends to managing the loan after disbursement. Two core systems ensure efficiency in this process: Loan Origination Systems (LOS) and Loan Management Systems (LMS). Each system plays a distinct role in the loan lifecycle, yet both aim to streamline lending operations.

Jun 23 ,2025 - 3 min readI. Introduction to Loan Origination vs Loan Management Systems

In the rapidly evolving financial landscape, the need for efficiency, automation, and compliance in lending processes is more significant than ever. Two pivotal systems—Loan Origination Systems (LOS) and Loan Management Systems (LMS)—are at the core of these advancements. Each plays a distinct yet complementary role in facilitating lending operations, ensuring loans are efficiently processed, managed, and serviced over time.

Understanding the differences between these two systems is crucial for financial institutions to select the right technology solution that will support their operational needs and provide a seamless experience for their customers. In this article, we’ll break down the key differences between loan origination vs loan management, explore the unique features of each system, and showcase how LendVero from FPT IS integrates both functionalities to deliver a unified, powerful lending solution.

II. What is Loan Origination?

Loan origination refers to the entire process through which a borrower applies for a loan and secures approval from the lender. This process involves several critical steps, starting from pre-qualification, moving through the application stage, document verification, underwriting, approval, and finally disbursement of the funds.

Given the complexity and volume of data involved, automating this process can significantly improve operational efficiency, reduce errors, and enhance customer experience. That’s where Loan Origination Systems (LOS) come into play, serving as the backbone for automating and optimizing the loan origination process.

Definition of Loan Origination Systems (LOS)

A Loan Management System (LMS) is a software solution that automates the administration of loans once they are approved and disbursed. LMS platforms enable lenders to track payments, manage delinquencies, calculate interest, and generate reports.

These systems are essential for maintaining operational efficiency and ensuring that loans are serviced properly over time.

Key Features of Loan Origination Systems

- Automated Decisioning: One of the most powerful features of LOS is the ability to automate loan decisioning. With pre-set business rules and sophisticated algorithms, the system can evaluate applications, assess risk, and provide decisions in a fraction of the time it takes for manual processing. This ensures quicker approvals and improves the borrower experience.

- Document Management: LOS platforms come equipped with robust document management capabilities, allowing borrowers to upload necessary documents directly into the system. The platform ensures that all documents are securely stored, easily accessible, and linked to the relevant stages of the loan process.

- Third-Party Integrations: LOS integrates seamlessly with external data providers, such as credit bureaus, for real-time credit checks and financial assessments. This ensures that loan officers have all the necessary information at their fingertips to make informed decisions.

- Regulatory Compliance: LOS ensures that every step of the loan origination process complies with national and international lending regulations. By automating compliance checks and reporting, the system mitigates the risk of non-compliance, saving lenders from potential fines or reputational damage.

- Customer Experience Optimization: An essential aspect of LOS is its focus on the customer journey. The system offers a user-friendly interface for borrowers to easily apply for loans, track their application status, and communicate with loan officers. This streamlined experience increases customer satisfaction and loyalty.

Technological Advancements in Loan Origination

The loan origination landscape is continuously evolving, thanks to the integration of emerging technologies like artificial intelligence (AI), machine learning (ML), and cloud computing. These innovations have significantly impacted how LOS operates:

- AI and ML: AI-powered LOS can assess borrower risk more accurately by analyzing vast amounts of data, beyond traditional credit scores. Machine learning algorithms help predict creditworthiness, providing lenders with deeper insights into a borrower's financial behavior.

- Cloud-Based Solutions: The shift towards cloud-based LOS has enabled scalability, flexibility, and cost savings for financial institutions. Cloud LOS platforms allow lenders to process more applications with fewer resources, and they can easily scale their operations to meet growing demands.

- API Integrations: LOS platforms are becoming more versatile with API-driven architectures, allowing lenders to integrate their LOS with other financial technology tools and platforms, enhancing functionality and streamlining workflows.

III. What is Loan Management?

Loan management, on the other hand, refers to the administration and oversight of a loan after it has been disbursed. The goal of loan management is to ensure that loans are serviced efficiently and that borrowers remain compliant with repayment terms.

Effective loan management covers activities such as payment collection, customer service, interest calculation, delinquency management, and reporting. Ensuring proper management is crucial for lenders to minimize risk, ensure profitability, and maintain a healthy portfolio of loans.

Definition of Loan Management Systems (LMS)

A Loan Management System (LMS) is software designed to manage the day-to-day servicing of loans once they have been disbursed. This includes tracking payments, calculating interest, managing delinquent accounts, and providing reporting for regulatory compliance. LMS platforms automate these processes to ensure accuracy and efficiency, helping financial institutions better serve their clients while maintaining operational control.

Key Features of Loan Management Systems

- Payment and Collection Tracking: LMS tracks all loan-related payments, including principal, interest, and fees, ensuring that the loan repayment schedule is followed accurately. This feature is critical for both lenders and borrowers as it helps in maintaining transparency and consistency.

- Interest Rate Management: The system automates the calculation of interest based on the agreed terms, ensuring that the correct amounts are charged and reducing the risk of manual errors.

- Delinquency and Default Management: An essential function of LMS is delinquency management. The system monitors late payments, sends reminders, and initiates collections processes if necessary. This helps reduce default rates and ensures the lender can recover the funds owed.

- Compliance and Reporting: LMS platforms are designed to handle compliance requirements, ensuring that all loan servicing activities meet regulatory standards. They also provide robust reporting capabilities, offering insights into loan performance and portfolio risk.

- Borrower Portal: A borrower portal allows clients to view their loan status, make payments, and interact with customer service representatives. This feature enhances the borrower experience and helps improve customer retention.

Importance of Digital Loan Management Systems

In a highly competitive financial market, digital loan management systems offer significant advantages. By digitizing the loan servicing process, lenders can handle higher loan volumes with fewer resources, reduce operational costs, and minimize errors. Furthermore, digital LMS platforms integrate easily with other financial systems, allowing for better visibility and control over loan portfolios.

IV. Key Differences Between Loan Origination vs Loan Management

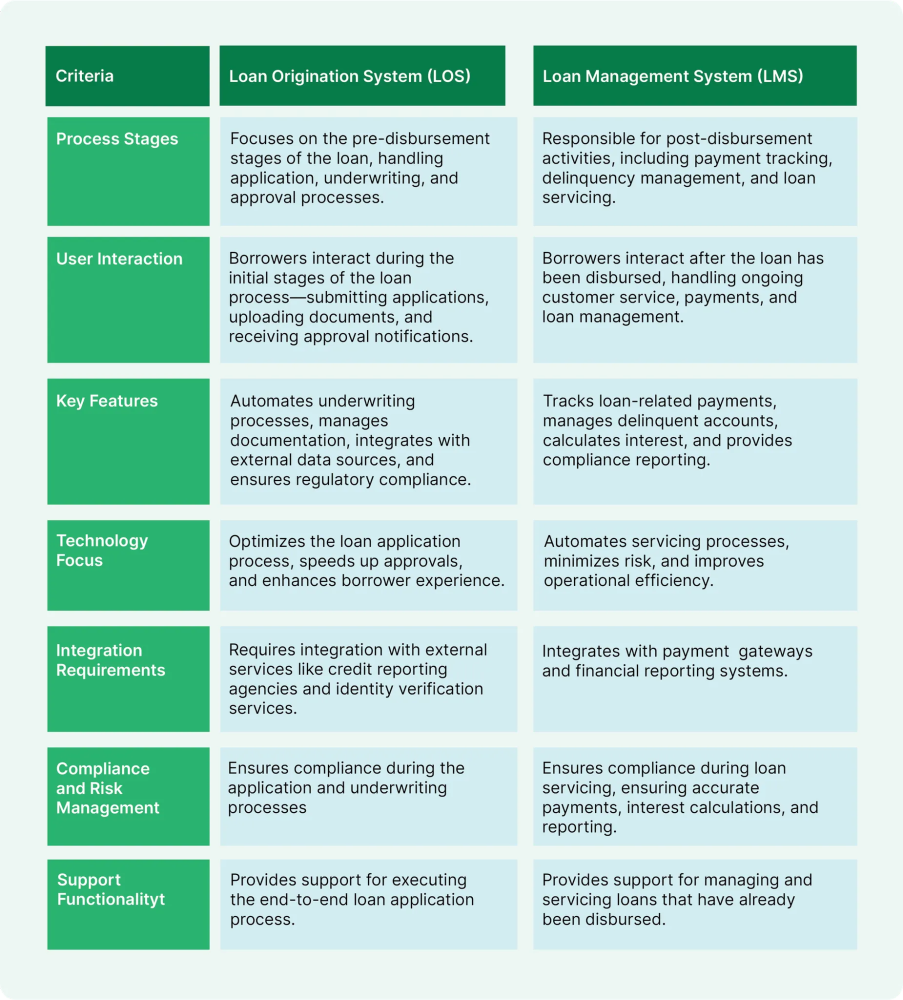

Understanding the differences between Loan Origination Systems (LOS) and Loan Management Systems (LMS) is crucial for financial institutions looking to optimize their lending processes. While both systems are integral to the overall lending lifecycle, they serve distinct purposes and cater to different stages of the loan process. LOS is primarily focused on the pre-disbursement activities involved in processing a loan application, whereas LMS is designed to manage the ongoing servicing of a loan after it has been disbursed.

To further illustrate these differences, the following table provides a comprehensive comparison between LOS and LMS across several key criteria:

V. How LendVero Supports Both Loan Origination vs Loan Management

LendVero, developed by FPT IS, is a comprehensive digital lending platform designed to support both loan origination vs loan management. By integrating both systems into one platform, LendVero provides financial institutions with an all-in-one solution that optimizes their lending operations.

LendVero’s Features for Loan Origination

Credit Scoring and Risk Assessment: LendVero integrates credit bureaus and advanced risk modeling techniques to streamline the credit assessment process, enabling faster loan approvals

Automated Underwriting: The platform offers automated decision-making tools that can quickly assess loan applications and streamline the approval process.

LendVero’s Features for Loan Management

Real-time Loan Tracking: LendVero provides lenders with real-time insights into loan repayment schedules and performance, helping mitigate risks associated with loan defaults.

Digital Collection Strategies: With integrated collection tools, LendVero automates repayment schedules, reminders, and collections, reducing operational burdens and improving recovery rates

Real-Life Example/Case Study

LendVero has successfully helped JACCS International Vietnam Finance Company Limited (JIVF) streamline its loan management operations. By implementing LendVero's Loan Management System, JIVF achieved:

- 70% faster loan application processing

- 100% eKYC accuracy through integration with the Ministry of Public Security

- Optimized workflows and document management with an advanced Loan Origination System (LOS)

LendVero empowers JIVF to enhance efficiency, security, and customer service, driving long-term growth and operational success.

Conclusion

Understanding the difference between Loan Origination vs Loan Management Systems is crucial for lenders aiming to enhance their lending operations. LOS handles the front-end processes, while LMS manages loans after disbursement.

LendVero stands out by offering a unified solution that streamlines both origination and management, ensuring efficiency and reducing risks throughout the loan lifecycle. As financial technology evolves, platforms like LendVero are at the forefront of transforming the lending landscape.