Role of Digital Platforms in Revolutionizing Lending Sector

The financial landscape is undergoing a significant transformation as nearly all banking processes shift to digital platforms. This digital evolution is revolutionizing the lending sector, making it crucial to understand how these changes impact consumer lending. Traditional lending processes, which involve a lengthy series of steps from customer onboarding to final loan disbursal, face numerous challenges such as inefficiencies and delays.

Mar 25 ,2025 - 3 min readLeveraging digital platforms in revolutionizing the lending sector can address these issues, offering more streamlined, efficient, and customer-centric solutions. By embracing digital technology, financial institutions can enhance their operations, improve decision-making, and deliver superior customer experiences.

Overview of the current financial landscape.

The financial sector is undergoing a dramatic transformation, with digital platforms in revolutionizing the lending sector playing a pivotal role in reshaping banking and lending processes. As traditional banking evolves, the integration of technology into financial services has become essential. Nearly all banking processes are now digitized, paving the way for more efficient, transparent, and accessible financial services.

Introduction to Consumer Lending

Overview of consumer lending and its importance in the economy.

Consumer lending is a cornerstone of modern economies, providing individuals with the means to finance personal and household expenditures, from purchasing homes and cars to covering emergency expenses. This segment of the financial industry encompasses various types of loans, including personal loans, auto loans, and mortgages.

Consumer lending plays a crucial role in stimulating economic growth by enabling consumers to make significant purchases and investments. It supports not only personal financial health but also broader economic stability and growth.

Key challenges in traditional consumer lending processes.

Despite its importance, traditional consumer lending faces several challenges:

- Lengthy Processing Times: The traditional loan approval process can be time-consuming, often requiring several weeks to complete.

- Paper-Intensive Procedures: Manual documentation and paperwork slow down the process and increase the risk of errors.

- Limited Accessibility: Traditional lending processes may exclude individuals with limited credit histories or those living in remote areas.

- High Operational Costs: Banks and financial institutions often incur significant costs in managing and processing loans manually.

The existing lending process:

In traditional lending, the journey to securing a loan is often time-consuming and involves multiple steps, each designed to assess the risk and ensure compliance. This process can take days or even weeks to complete, leading to delays and frustration for both the borrower and the lender.

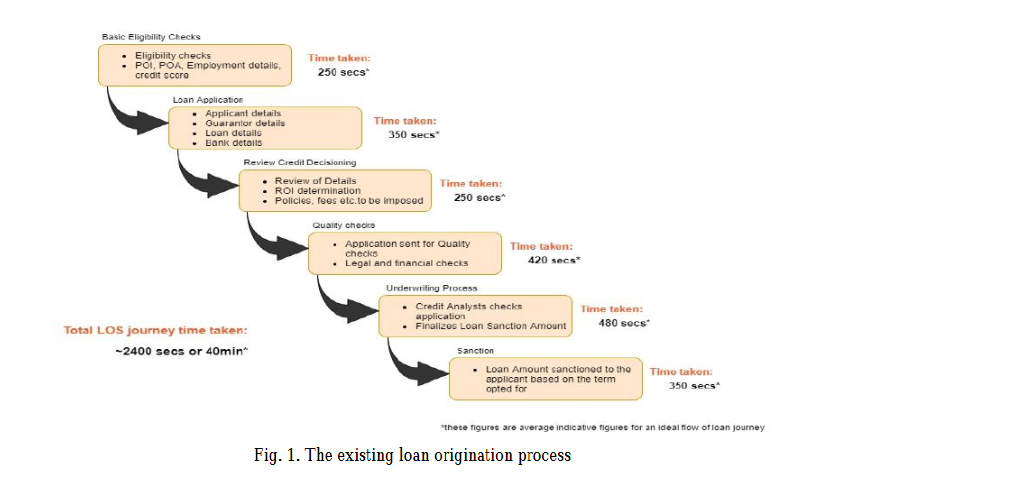

3.1. The existing loan journey consists of more or less the following steps:

Digital platforms in revolutionizing the lending sector have significantly altered the traditional loan journey, making it faster and more efficient. These advanced platforms, such as those offered by LendVero, streamline the entire loan process from customer onboarding to final disbursement, reducing the time required to secure a loan to as little as 30 minutes.

Step 1: Onboarding Customer:

The lending process begins when a customer expresses interest in obtaining a loan. During this initial stage, the customer provides basic information such as their name, contact details, and the loan amount they are seeking. This step is relatively straightforward but can still take time as the information is manually collected and entered into the system.

Step 2: Applicant details and Documents:

Once the customer is onboarded, the lender requires the applicant to provide detailed personal and financial information. This includes submitting documents like proof of income, credit history, identification, and sometimes collateral details. The collection and verification of these documents can be a lengthy process, especially if any information is missing or unclear.

Step 3: Credit and Risk Assessment:

The third step involves evaluating the applicant's creditworthiness and assessing potential risks. Lenders manually review the applicant's credit score, financial history, and current debt obligations. This process is critical to ensuring the lender's financial safety but can be slow and prone to human error.

Step 4: Underwriting:

During underwriting, the lender determines the specific terms and conditions of the loan, such as the interest rate and repayment period. This step is heavily dependent on the outcome of the credit and risk assessment and often requires further analysis, which adds time to the overall process.

Step 5: Legal Check:

A legal check is conducted to ensure that all aspects of the loan agreement comply with relevant laws and regulations. This step involves verifying the accuracy of the information provided and ensuring that the contract is legally binding. Legal checks can be time-consuming, especially in jurisdictions with complex regulatory requirements.

Step 6: The Final Loan Deal, Signing the Agreement, & Disbursal:

The final step involves reviewing, signing the loan agreement, and disbursing the funds. Traditional methods of signing and transferring funds could be slow. Digital platforms in revolutionizing the lending sector facilitate electronic signatures and seamless integration with payment systems, accelerating the disbursal process.

3.2. Issues identified in conventional lending processes

Conventional lending processes often suffer from inefficiencies such as:

- Manual Processing Errors: The reliance on manual data entry and processing increases the likelihood of human errors. These errors can result in inaccurate credit assessments, incorrect documentation, and delays in loan approvals.

- Delayed Responses: Traditional lending processes are often slow, with prolonged turnaround times for loan approvals and fund disbursals. This delay is usually due to the need for manual review at multiple stages of the process, including underwriting and legal checks. As a result, customers may experience significant waiting periods before they receive the funds.

- Inadequate Customer Experience: The cumbersome procedures and lack of transparency in traditional lending can lead to a poor customer experience. Borrowers often face difficulties in tracking their loan application status, and the communication between lenders and borrowers may be limited, leading to frustration and dissatisfaction.

- Limited Personalization: Traditional lending processes typically struggle to offer personalized loan products tailored to individual customer needs. Due to the rigid structure of conventional systems, lenders may find it challenging to customize loan terms, interest rates, and repayment plans based on the unique financial situations of each borrower.

Leveraging digital technology to revolutionize the lending process

4.1. Tools and Techniques enabling digitalization of the lending process

The advent of digital technology has significantly revolutionized the lending process, introducing advanced tools and techniques that enhance both efficiency and customer experience. Digital platforms in revolutionizing the lending sector are pivotal in this transformation.

4.1.1. Fintech technological advances

Fintech innovations such as blockchain, cloud computing, and advanced analytics are transforming the way loans are processed. These technologies streamline operations, improve data security, and provide real-time insights.

4.1.2. User Experience in FinTech (UI/UX)

User-friendly interfaces and seamless user experiences are critical in fintech. Digital platforms prioritize intuitive design and ease of use, ensuring that customers can navigate the loan application process effortlessly.

4.1.3. A digital ecosystem

A comprehensive digital ecosystem integrates various technological components, including digital payment systems, data analytics, and customer relationship management (CRM) tools. This interconnected approach enhances operational efficiency and customer satisfaction.

4.1.4. Business modeling that is novel

Innovative business models, such as peer-to-peer lending and digital-only banks, offer alternative approaches to traditional lending. These models leverage technology to provide more flexible and accessible financial services.

4.1.5. A Customer-Oriented Approach

Digital lending platforms focus on delivering a customer-centric experience, with personalized loan products and responsive customer support. This approach improves customer satisfaction and loyalty.

By integrating these advanced tools and techniques, digital platforms in revolutionizing the lending sector drive significant improvements in how loans are processed, benefiting both lenders and borrowers.

Leveraging Digital Technology in New Age Lending Processes - Conceptual Framework of Digital Lending

Advancements in financial technology (Fintech) have opened up significant opportunities to improve lending processes. Digital tools not only simplify processes but also significantly enhance the accuracy and efficiency of decision-making.

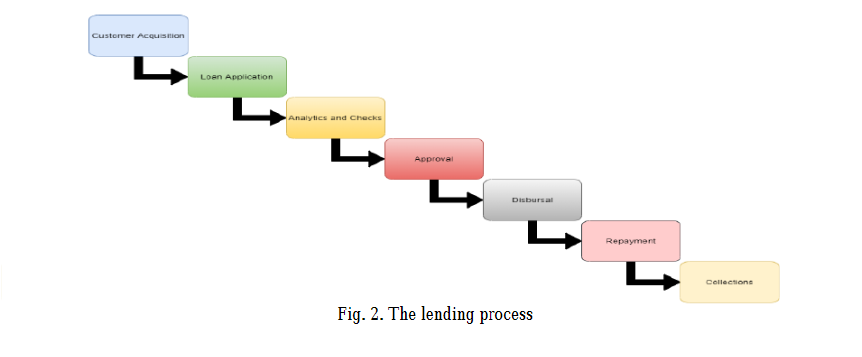

4.1. Acquisition of customers

Digital platforms streamline the customer acquisition process through advanced marketing tools, customer relationship management (CRM) systems, and automated lead generation. LendVero supports this stage with solutions such as omnichannel engagement platforms and data analytics tools that help identify and attract potential customers more effectively. LendVero provides:

- Customer Relationship Management (CRM) Systems: To manage customer interactions and data efficiently.

- Omnichannel Marketing Solutions: To engage potential customers across various digital channels.

- Lead Generation and Management Tools: To capture and nurture leads effectively.

4.2. Approval and Analytics

Approval and Analytics: Digital transformation greatly improves the approval process through the use of sophisticated analytics and automated decision-making systems.

LendVero provides advanced solutions like AI-driven risk assessment tools and real-time credit scoring systems, which enhance the accuracy of approvals and reduce processing times, leading to faster and more reliable loan decisions.

4.3. Disbursal and Repayment

The disbursal and repayment stages benefit from digital tools that automate transactions and manage payment schedules. LendVero offers seamless integration solutions that facilitate quick and secure disbursement of funds and automate repayment reminders and processing, ensuring a smooth and efficient experience for both lenders and borrowers.

LendVero provides:

- Digital Payment Solutions: For seamless and secure disbursement of funds.

- Automated Repayment Management Systems: To handle payment schedules and reminders.

- Integrated Loan Servicing Platforms: To streamline loan administration and customer service.

4.4. Collections

Digital platforms enhance the collections process by automating follow-ups and leveraging data analytics to predict and manage delinquent accounts.

LendVero’s collection management solutions include automated dunning processes and predictive analytics to optimize collections strategies and improve recovery rates.

Steps to digitalize the existing loan journeys

The process of digitizing lending processes includes the following steps:

- Evaluation and Development of ‘Digital Readiness’: Assess the organization's digital readiness and develop a comprehensive digital transformation plan to integrate digital platforms in revolutionizing the lending sector effectively.

- Set the Goals and Objectives for ‘Digital Lending’: Define specific goals and plans for implementing digital lending.

- Putting Together a Channel Strategy: Develop a distribution channel strategy to effectively reach customers.

- Identify Potential Partners or Integrations: Seek potential partners or technology integrations that can enhance digital services.

- Prioritize and Develop a Digital Maturity Roadmap: Prioritize necessary activities and build a suitable digital maturity roadmap.

LendVero's Role in the Digitalization of Consumer Lending

1. LendVero: A Pioneer in Digital Consumer Lending

LendVero stands out as a leader in digital consumer lending, leveraging cutting-edge technology to transform traditional lending processes. Its innovative platform integrates digital solutions to streamline loan applications, approvals, and disbursals.

2. Integration of Digital Technologies by LendVero

LendVero employs advanced digital technologies to enhance efficiency and customer experience:

- AI and Machine Learning: Utilized for sophisticated credit scoring and risk assessment, providing accurate and timely evaluations.

- Automation of Loan Application and Approval: Reduces processing times and improves operational efficiency, allowing for quicker decision-making.

3. Impact on Consumers and Financial Institutions

a. Benefits for Consumers:

- Faster Access to Credit: Speedy loan approvals and disbursals enable timely access to funds.

- Transparency and Convenience: Clear, straightforward processes and digital interfaces enhance customer satisfaction.

b. Advantages for Financial Institutions:

- Enhanced Risk Management: Advanced analytics and AI improve risk assessment and management.

- Cost Efficiency and Scalability: Automated processes reduce costs and allow institutions to scale operations effectively.

CONCLUSION

Digital platforms in revolutionizing the lending sector have dramatically transformed traditional lending processes, delivering enhanced speed, accuracy, and transparency. LendVero exemplifies how innovative digital solutions can streamline loan applications, approvals, and disbursals. By integrating cutting-edge technologies and automating key processes, LendVero not only improves operational efficiency but also elevates the customer experience. The future of lending is undeniably digital, and those who embrace these advancements will enjoy the benefits of a more agile, efficient, and customer-focused financial landscape.