Top 10+ Loan Management Software Solutions in Asia

The Asian financial environment has expanded significantly during the last decade, notably in the loan sector. The demand for effective loan management solutions has increased dramatically as more people and companies look for financial support. To remain competitive, financial institutions must implement innovative software that streamlines loan management procedures, assures regulatory compliance, and improves the client experience.

Jun 23 ,2025 - 4 min readWhat is Loan Management Software?

Overview of Loan Management Software

Loan Management Software (LMS) is a digital platform that automates the whole loan process, from application to repayment. It streamlines critical activities such as loan origination, servicing, and collection, allowing you to increase productivity, decrease mistakes, and improve client experiences.

An LMS is a crucial tool for digital lending organizations. It helps lenders manage loan portfolios, evaluate risks, and maintain compliance with regulations.

Core Functions

- Loan Origination: Simplifying the process of gathering and reviewing loan applications.

- Credit Scoring: Using automated scoring algorithms to assess applicants' creditworthiness.

- Loan Servicing: Monitoring the ongoing activities of open loans, such as processing payments and updating accounts.

- Collections: Managing delinquent accounts and assisting with debt recovery methods.

Benefits of Using Loan Management Software

- Efficiency: Automating routine tasks simplifies loan processing and minimizes human error.

- Compliance: Ensuring conformance to regional rules, reducing the chance of legal complications.

- Scalability: The capacity to handle increases in the number and complexity of loans without sacrificing effectiveness.

- Customer satisfaction: Enhancing customer experience by offering quicker, more accurate service.

- Data security: Implements robust security procedures to protect sensitive financial information.

Key Features to Consider in Loan Management Software

When selecting tools to manage their loan portfolios, lenders should search for software that reduces their reliance on human labor. As with other businesses, digital solutions may significantly minimize the possibility of human error, resulting in increased income. Lenders may grow their companies without taking on more risk if they use the correct loan management system, which also enhances data security.

Automation Capabilities

Automation is an essential component of loan management software. It allows for effectively managing repeated operations such as loan application processing, credit rating, and payment tracking. Automation lowers human error, accelerates operations, and helps employees to concentrate on more critical tasks.

Compliance with Regional Regulations

In Asia, regulatory standards differ for each nation. Consequently, selecting loan management software that facilitates adherence to regional laws is critical. This includes data protection regulations, anti-money laundering (AML) standards, and special financial reporting requirements.

Scalability

Your loan management software should be scalable to expand with your organization. Companies should look for systems that can handle an expanding number of loans, clients, and complicated financial products while maintaining performance.

Integration with Other Systems

Integration with current systems, including accounting software, CRM platforms, and payment gateways, is critical. This guarantees a smooth flow of information throughout your firm, minimizing data silos and increasing overall efficiency.

User-Friendly Interface

A user-friendly interface ensures that your employees can rapidly understand and utilize the product. Critical elements of an easy-to-use loan management solution include transparent reporting, intuitive navigation, and reachable customer service.

Customer Support

When establishing and managing loan management software, adequate customer assistance is critical. Your business needs to ensure the supplier offers extensive assistance, such as training, troubleshooting, and frequent software upgrades.

Top Loan Management Software Solutions in Asia

In this section, we will discover the top 10 loan management software programs in Asia and outline each one's salient characteristics, advantages, pricing, and best practices for commercial applications.

ABLE Platform

ABLE Platform is a robust debt management system used by a variety of Asian financial institutions. It is well-known for its robust automation features and easy integration.

1. Key features:

- Automated workflows for loan approval and processing

- Real-time reporting and analysis

- Multicurrency and multilingual support

- Adaptable user interface and dashboards

2. Strengths: Businesses may customize the ABLE Platform to meet their unique requirements because of its exceptional customization capabilities. It is perfect for companies that operate in several Asian markets since it supports numerous currencies and languages.

3. Pricing: Based on the size and needs of the business, custom pricing is provided.

4. Ideal for: Big financial firms that require a lot of customization and have complicated loan portfolios.

LoanAssistant

LoanAssistant is a cloud-based loan management service developed for small and medium-sized businesses (SMEs). It has a user-friendly design and focuses on making loan servicing activities easier.

1. Key features:

- Automated payment reminders and delinquency management

- Detailed borrower profiles and credit scoring

- Integration with accounting and CRM systems

- Cloud-based accessibility

2. Strengths: LoanAssistant is easily accessible with a cloud-based platform that allows organizations to handle loans from anywhere. It excels at managing borrowers and tracking loans.

3. Pricing: Starting at $999.

4. Ideal for: Small and medium-sized enterprises (SMEs) seeking a cheap, user-friendly credit management solution.

Neofin

Neofin is a comprehensive loan management software noted for its extensive analytics and reporting capabilities. It is commonly utilized by microfinance organizations in Asia.

1. Key features:

- Advanced risk management tools

- Customizable loan products and repayment schedules

- Integration with mobile banking platforms

- Multi-level user access control

2. Strengths: Neofin's risk management features set it apart, making it appropriate for microfinance organizations that need to analyze and manage borrower risk properly.

3. Pricing: $1,599 per month.

4. Ideal for: Microfinance institutions and non-governmental organizations that promote financial inclusion.

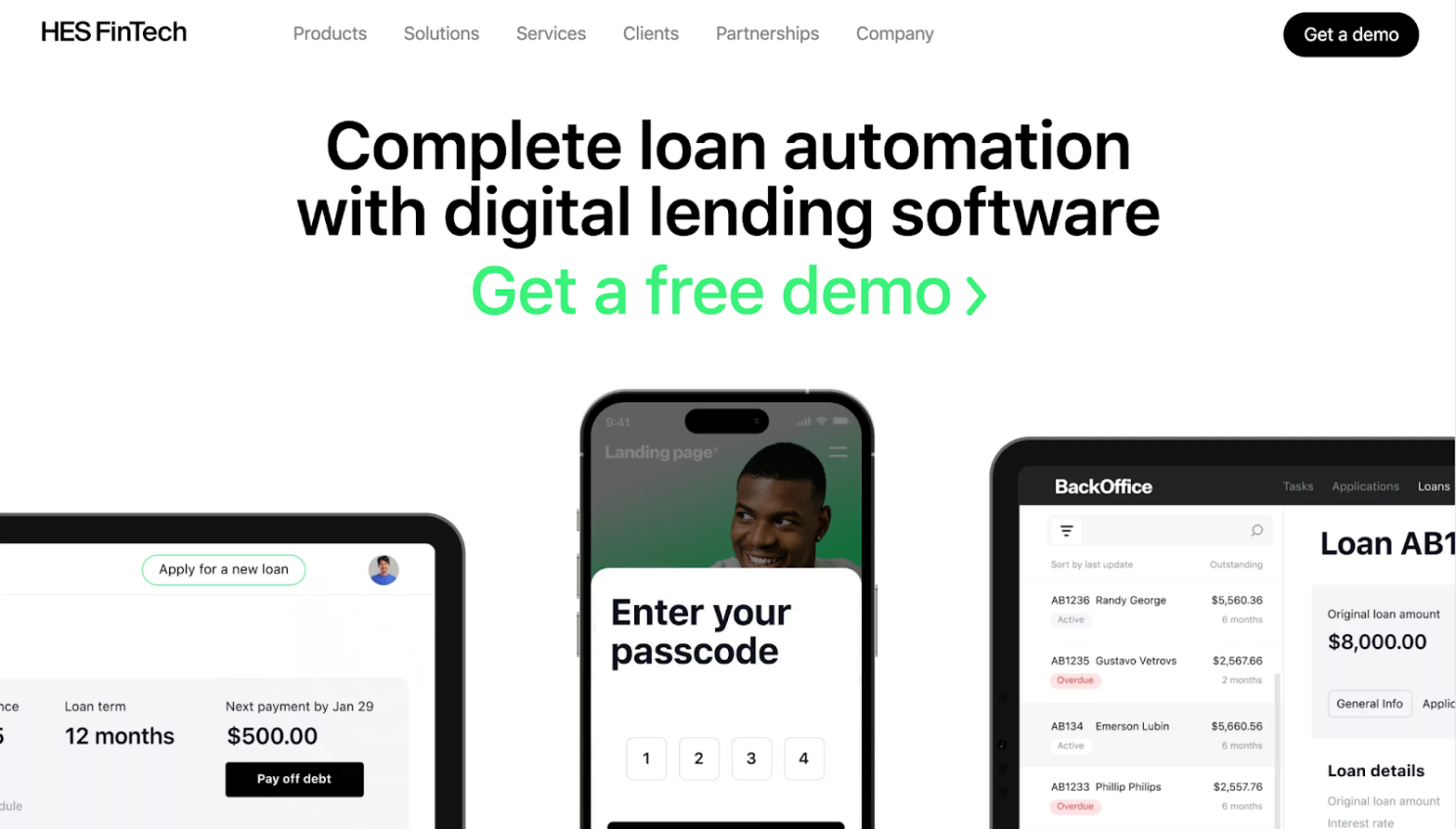

HES Fintech

HES Fintech provides a versatile debt management platform tailored to various company models. It is popular among Asia's fintech firms and digital lenders.

1. Key features:

- End-to-end loan origination and servicing

- AI-powered credit scoring and risk assessment

- White-label solutions for branding

- API integrations with third-party services

2. Strengths: HES Fintech's versatility and customization possibilities make it an excellent alternative for fintech businesses seeking to innovate in the lending market. Its AI-powered technologies offer a competitive advantage in credit rating.

3. Pricing: Based on features and customization requirements.

4. Ideal for: Fintech firms and digital lenders are looking for a platform that can be customized and scaled.

LoansNeo

LoansNeo is an advanced loan management software for Asian banks and credit unions. It provides tools for managing various forms of loans, from personal to commercial.

1. Key features:

- Loan origination and underwriting automation

- Regulatory compliance tools

- Real-time loan performance tracking

- Centralized document management

2. Strengths: LoansNeo is excellent for conventional financial institutions since it handles intricate loan portfolios and guarantees adherence to regional laws.

3. Pricing: Based on the institution's size and loan volume.

4. Ideal for: Banks and credit unions with a range of lending options and stringent requirements for compliance.

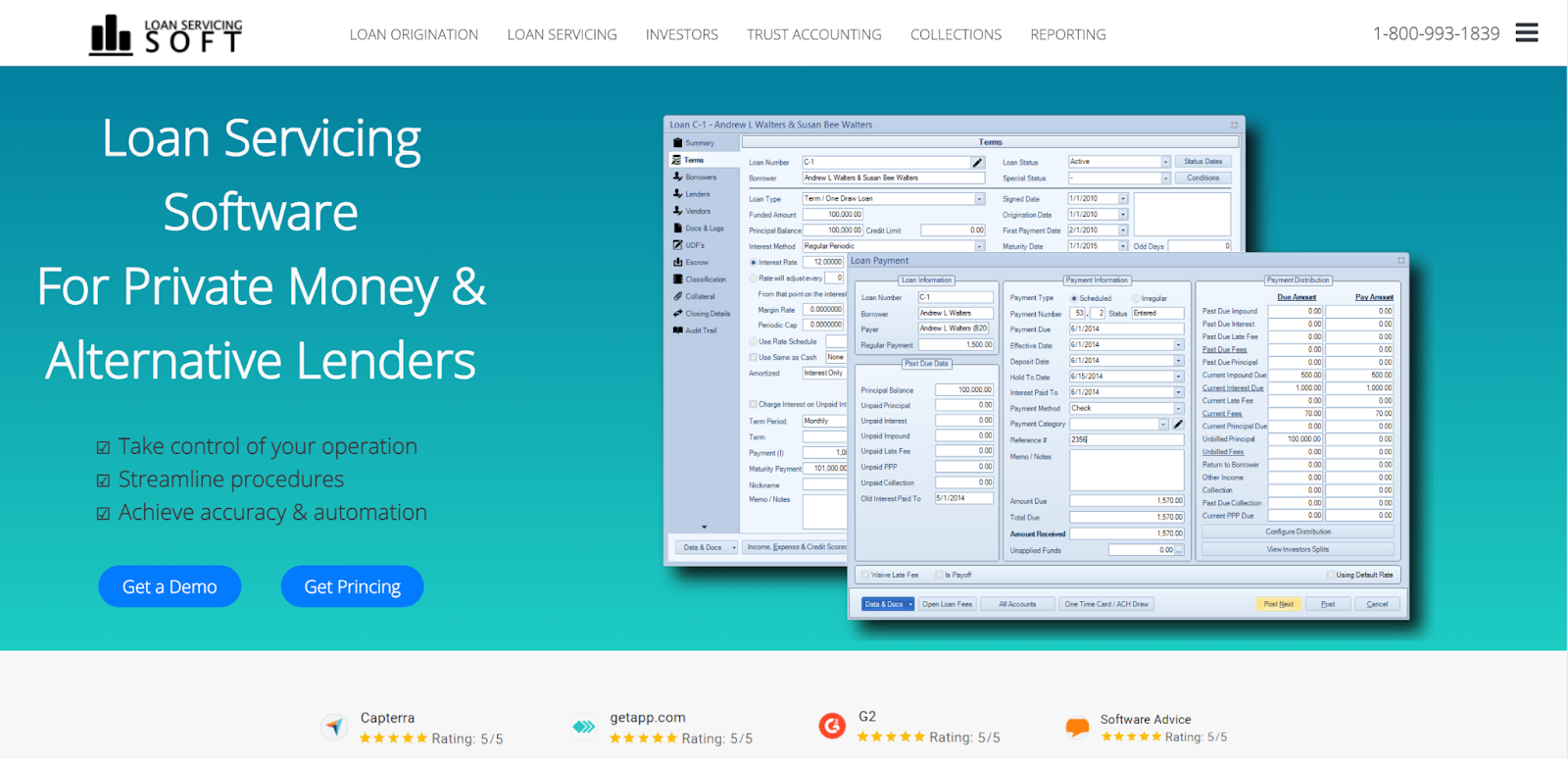

Loan Servicing Soft

Loan Servicing Soft is an enterprise-level loan management platform that offers extensive solutions for managing big loan portfolios. It is popular among major banks and financial organizations.

1. Key features:

- Automated loan servicing and collection

- Detailed audit trails and reporting

- Integration with accounting and CRM software

- High-level security features

2. Strengths: Loan Servicing Soft specializes in managing enormous numbers of loans and has solid security features, making it ideal for major financial institutions with strict compliance requirements.

3. Pricing: $500 per month.

4. Ideal for: Large banks and financial institutions with significant loan portfolios.

CloudNBFC

CloudNBFC is a cloud-based loan management system for Asian non-banking financial companies (NBFCs). It provides scalability and flexibility to satisfy the changing demands of the NBFC sector.

1. Key features:

- Loan origination and underwriting automation

- Real-time analytics and performance tracking

- Compliance management tools

- Mobile-friendly interface

2. Strengths: CloudNBFC's cloud-based design helps NBFCs to scale operations effectively. Its mobile-friendly interface allows customers to manage loans on the go.

3. Pricing: Based on the business’s needs.

4. Ideal for: NBFCs looking for a scalable, mobile-friendly loan management solution.

LENDperfect

LENDperfect is a powerful loan management platform that offers complete loan processing solutions. It is often utilized by Asian lenders, both traditional and digital.

1. Key features:

- Automated loan processing and approval

- Advanced credit risk management

- Multi-currency support

- Detailed borrower profiling and reporting

2. Strengths: LENDperfect's comprehensive risk management and multi-currency capabilities make it a popular choice among lenders in numerous Asian regions.

3. Pricing: $50000 for one-time payment.

4. Ideal for: Traditional financial institutions and digital lenders that prioritize risk management.

Shaw Systems

Shaw Systems provides an effective loan servicing platform to both retail and business lenders. It offers various capabilities for managing the entire loan lifetime.

1. Key features:

- Loan origination and servicing automation

- Risk and compliance management

- Customizable reporting and analytics

- Integration with third-party systems

2. Strengths: Shaw Systems is remarkably adaptable, allowing lenders to tailor the program to their operations. It's excellent for lenders that need sophisticated reporting and compliance tools.

3. Pricing: Based on business requirements.

4. Ideal for: Retail and commercial lenders requiring a flexible and comprehensive debt management solution.

Loan Blaster

Loan Blaster is a user-friendly loan management solution for small enterprises and credit unions. It is designed for simplicity and ease of use.

1. Key features:

- Loan application and approval automation

- Simple borrower management

- Basic reporting and analytics

- Integration with accounting software

2. Strengths: Loan Blaster's simplicity makes it a good alternative for small businesses and credit unions who want a low-cost, basic solution without the complexities of enterprise-level software.

3. Pricing: Based on business demands.

4. Ideal for: Small companies and credit unions searching for an affordable and user-friendly loan management solution.

LendVero

LendVero is an innovative loan management platform that uses artificial intelligence and machine learning to improve loan origination and servicing procedures.

1. Key features:

- AI-powered loan origination and credit scoring

- Real-time performance monitoring

- Regulatory compliance tools

- Integration with mobile and web platforms

2. Strengths: LendVero stands out for its use of AI and machine learning, which provides superior credit scoring and risk assessment capabilities. It is ideal for lenders that want to integrate cutting-edge technology into their operations.

3. Pricing: Subscription-based pricing with custom options based on features.

4. Ideal for: Lenders want advanced technology to enhance loan administration and credit evaluation.

How to Choose the Right Loan Management Software For Your Business

Choosing an appropriate loan management software is an important choice that will significantly influence your company's productivity and compliance. To make an informed choice, it is essential to consider the following criteria:

Assessing Your Business Needs

It is critical to know and evaluate your company's requirements properly. You need to analyze your present loan management procedures, find opportunities for improvement, and consider the size and complexity of your loan portfolio and the specific features of your target market.

Evaluate Software Features and Flexibility

When selecting loan management software, it is essential to consider the individual features and levels of flexibility provided by each system. You should ensure that the software offers critical features like automation, compliance support, scalability, and flexibility to adapt to your company model and development objectives.

Consider Scalability and Future Growth

It is crucial to select software that meets your current needs while also considering scalability and future expansion potential. As your firm grows, the software should be able to handle a rising number of loans, clients, and increasingly complicated financial products.

Look for Customization and Integration Capabilities

Evaluating the loan management software's customization and integration capabilities is critical. To maximize productivity and reduce operational disruptions, the solution of choice should be able to interface smoothly with your current systems and provide customization choices that correspond to your unique company's demands.

Review User Support and Training Options

A seamless software deployment process and continued software use depend on a review of the user assistance and training alternatives offered. You must confirm that the software supplier provides extensive support and training tools to help you realize the product's benefits and overcome emerging issues.

The Future of Loan Management Software in Asia

Significant technology breakthroughs and shifting market demands will shape the future of Asian loan management software. The loan management industry is about to change thanks to emerging trends like blockchain technology and AI-powered credit scoring, which will provide more transparent, efficient, and safe procedures. Furthermore, the expanding usage of mobile loan management services reflects lenders' and borrowers' growing need for accessibility and convenience.

Financial institutions are anticipated to embrace these new technologies to remain competitive as the loan market in Asia grows. The increasing market need for new solutions will encourage further development of loan management software, making it more durable, versatile, and capable of dealing with the complexity of modern lending.

Furthermore, loan management software must be updated regularly to guarantee compliance with Asia's constantly changing financial legislation. Keeping up with modifications to financial reporting requirements, anti-money laundering (AML) guidelines, and data protection legislation is part of this. As regulatory frameworks change, loan management software's capacity to adapt rapidly will be crucial for financial institutions looking to reduce risks and preserve operational integrity.

Conclusion

In summary, choosing the appropriate loan management software is crucial because the Asian financial sector is constantly changing. The software solutions mentioned in this article illustrate the various accessible possibilities, each with distinct features and capabilities customized to particular company needs.

Whether your firm is a substantial financial institution or a fledgling fintech startup, investing in the proper technology is critical for remaining competitive, maintaining regulatory compliance, and providing excellent customer experience. The significance of sophisticated loan management software in the region's ever-changing credit industry will only increase with the speed of the digital revolution.